by The Real Dirt | Jun 7, 2021 | 420 News, Blog, Business, Cannabis Law and Compliance, Cannabis News, Hemp, Industry News, Legalization

When Mid-Hudson Correctional Facility closed in 2011, it freed up 740 acres of prime property that its host community, Warwick, readily bought for $3.1 million.

During the past decade, the town has actively worked to repurpose the property and has seen positive results from its efforts. With Covid-19 fading and the state reopening, business is again percolating on the former prison property, now known as Wickham Woodlands.

Along with a new Warwick Valley Office and Technology Corporate Park on the campus, where the town’s business accelerator is working with three-startup companies, business is growing along its winding State School Road: a former administration building has become the trendy Drowned Lands Brewery; the prison’s old guard tower is now the gateway to Hudson Sports Complex; and the land surrounding Wickham Lake, which inmates could view from behind barbed wire fencing, has been turned into a town park.

The Warwick Valley’s fertile landscape also offers ample opportunities for those who grow hemp and its soon-to-be-street legal counterpart, marijuana, and is seeing that business beginning to boom within Wickham Woods’ borders.

When the United States eased federal regulations on growing hemp in 2018, the floodgates of products produced from hemp’s byproduct, cannabidiol — better known to the public as CBD — started hitting the shelves.

Medical marijuana has been legal since 2016, and the state also relaxed its regulations for CBD-infused food and beverages. In April, 2021, the New York state Legislature approved the legalization of recreational marijuana, which has opened a whole new revenue stream for cultivators.

Those measures have propelled Wickham Woods into the spotlight for those with a vested interest in both legal hemp/cannabis cultivation and CBD production.

Chicago-based Fiorello Pharmaceuticals/Green Thumb Industries is poised to build a 100,000-square-foot cannabis growing and processing facility on 40 acres in the technology park.

The company received approval in May from the Orange County Industrial Development Agency for subsidies that include a sales and tax use exemption, mortgage recording tax exemption and a 15-year payment in lieu of taxes, as well as approval for the issuance of taxable revenue bonds.

by The Real Dirt | May 12, 2021 | 420 Culture & Travel, 420 News, Blog, Business, Cannabis Law and Compliance, Culture, Legalization, Medical Marijuana

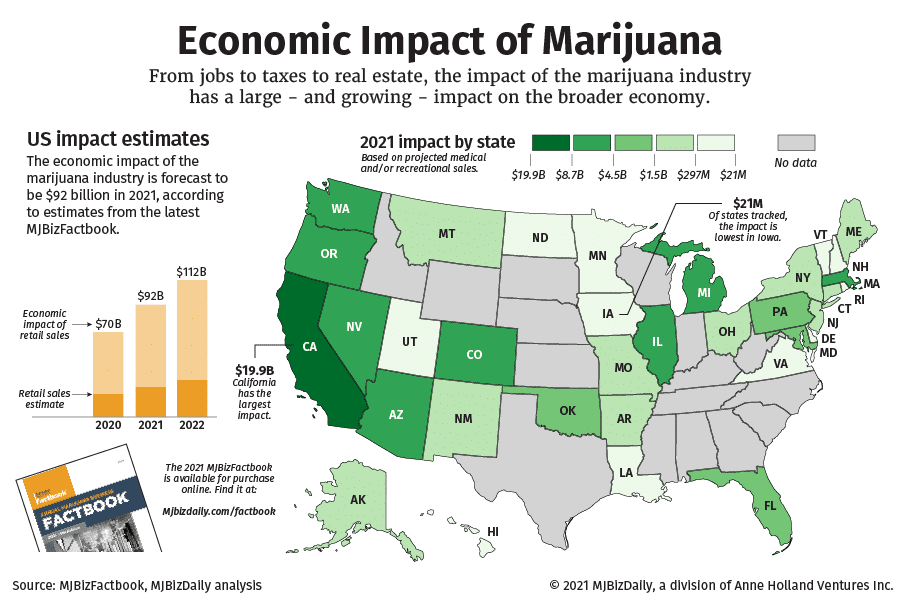

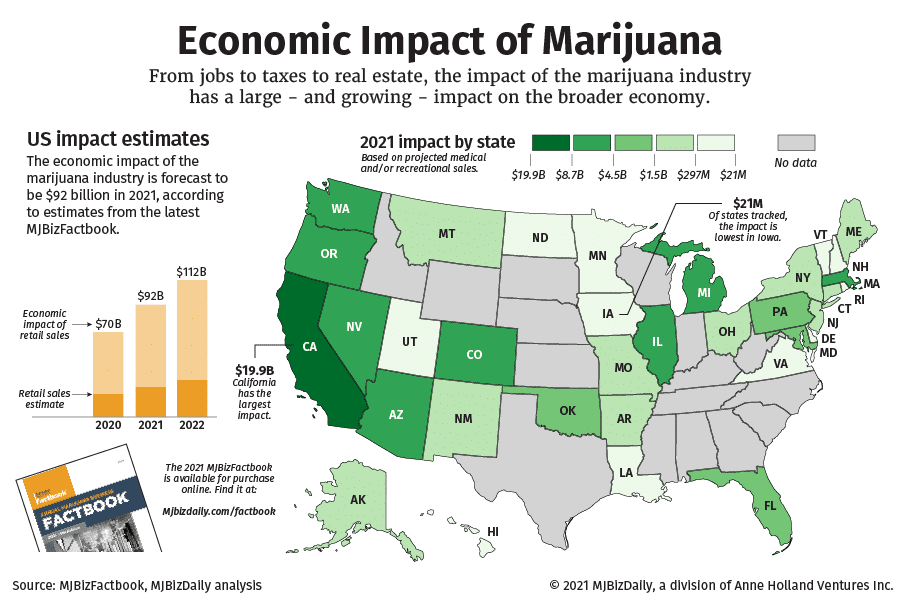

From jobs to tax revenue to commercial real estate, the marijuana industry has a large – and growing – impact on the broader economy in the United States.

The total U.S. economic impact from marijuana sales in 2021 is expected to reach $92 billion – up more than 30% from last year – and upwards of $160 billion in 2025, according to analysis from the newly published MJBizFactbook.

To measure the industry’s economic impact, MJBizDaily analyzed similar industries and applied a standard multiplier of 3.5 on projected recreational and medical marijuana retail sales.

The numbers are a best guess because the marijuana industry’s structure is somewhat unique because it encompasses agricultural, manufacturing and retail activity.

The economic impact of the marijuana industry is not the same as supply-chain revenues that are often used to estimate the “total size” of an industry.

Rather, the economic multiplier paints a picture of the impact the industry has on the broader economy.

In this case, for every $1 consumers and patients spend at retail locations, an additional $2.50 will be injected into the economy, much of it at the local level.

That impact comes directly from the day-to-day needs of workers in the cannabis industry, including spending on life’s necessities such as housing, transportation, entertainment and more.

Marijuana businesses, consumers and patients also pay hundreds of millions of dollars in state and local taxes that are used to fund state and local government activities, including schools and roads.

In addition, real estate receives a boost from new retail, manufacturing and agricultural businesses moving into an area or established companies expanding, increasing broader demand for commercial properties.

Cultivating and manufacturing marijuana can require large investments in equipment and technology that boost not only the local economy but also areas throughout the U.S.

The list goes on.

Using the same multiplier methodology can also offer insight into the local-dollar impact from sales of recreational and/or medical marijuana.

The economic impact will vary by state based on the size, maturity and type of market.

For example, as the largest market in the U.S., California’s marijuana industry is expected to pump close to $20 billion into the state’s economy in 2021.

No other state comes close to that amount.

But states such as Colorado, Illinois, Oregon and Washington will provide more than $10 billion each for their local economies in the coming years.

Expect the same for markets in densely populated states such as New Jersey and New York as they develop.

If we consider total population, some states benefit more than others.

by The Real Dirt | Feb 17, 2021 | 420 News, Blog, Business, Culture, Legalization, Medical Marijuana

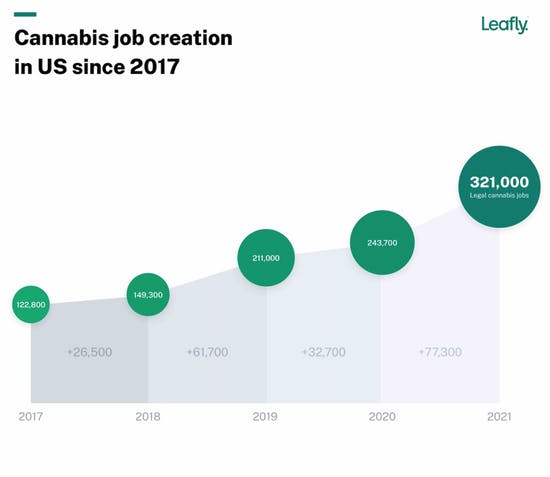

How many jobs are there in America’s legal marijuana industry?

The 2021 Leafly Jobs Report, issued earlier today, found 321,000 full-time equivalent (FTE) jobs supported by legal cannabis as of January 2021. That total includes both plant-touching and ancillary jobs—everyone from budtenders to bean-counters.

To put that in perspective: In the United States there are more legal cannabis workers than electrical engineers. There are more legal cannabis workers than EMTs and paramedics. There are more than twice as many legal cannabis workers as dentists.

The annual Leafly Jobs Report, produced in partnership with Whitney Economics, is the nation’s cornerstone cannabis employment study.

Federal prohibition prevents the US Department of Labor from counting state-legal marijuana jobs. Since 2017, Leafly’s news and data teams have filled that gap with a yearly analysis of employment in the legal cannabis sector.

Whitney Economics, a leading consulting firm that specializes in cannabis economics, policy, and business consulting, has partnered with Leafly on the project since 2019.

Twice the job growth as 2019

Cannabis job growth in 2020 represents a doubling of the previous year’s US job growth. In 2019, the cannabis industry added 33,700 new US jobs for a total of 243,700.

Despite a year marked by a global pandemic, spiking unemployment, and economic recession, the legal cannabis industry added 77,300 full-time jobs in the United States in 2020. That represents 32% year-over-year job growth, an astonishing figure in the worst year for US economic growth since World War II.

Cannabis now an $18.3 billion industry in the United States

In 2020, Americans purchased $18.3 billion worth of cannabis products, a 71% increase over 2019.

When the COVID-19 pandemic hit the United States in March, many in the cannabis industry worried about a potential industry-wide shutdown. Instead, governors in most states declared cannabis an essential product. Dispensaries and retail stores responded by offering online ordering, curbside pickup, and delivery as COVID-safe options for their customers.

Customers responded by stocking up for months of stay-at-home advisories and social distancing. After a brief dip in late-March revenue, most stores saw a significant bump in April—and then the bump became a plateau.

by The Real Dirt | Jan 20, 2021 | 420 News, Blog, Business, Cannabis Law, Cannabis Law and Compliance, Medical Marijuana

Medical marijuana sales in Arkansas reached $175 million in 2020, ending the year with a record $1.22 million day.

The Marijuana Business Factbook projects that Arkansas MMJ sales will nearly double this year to $300 million-$365 million, boosted by new items such as edibles and vape products. The state recently opened up licensing for processors.

The state’s dispensaries sold 26,000 pounds of medical marijuana products in 2020, Medical Marijuana Commission spokesman Scott Hardin told Arkansas Public Radio.

The market, which launched in May 2019, started 2020 with fewer than 10 dispensaries but ended the year with 32, according to the report.

Six additional licensed retail entities are working toward opening for business, Hardin wrote in a recent email to Marijuana Business Daily.

Meanwhile, a medical marijuana dispensary in Hot Springs filed a lawsuit alleging that three cultivators have refused to sell product to the retailer, costing the outlet $5 million.

Green Springs Medical Dispensary, once the state’s leading seller, is requesting that the Garland County Circuit Court bar the growers from boycotting the dispensary, according to The Sentinel-Record in Hot Springs.

CEO Dragan Vicentic also wants state regulators to impose a rule that prohibits cultivators from refusing to sell to dispensaries, which his lawsuit claims violates federal antitrust laws.

He claims the growers are retaliating against his comments to regulators that the state needs more cultivators because the existing ones cannot meet dispensaries’ demand. There are currently only eight licensed cannabis cultivators in the state to meet the demand of 32 dispensaries.

by The Real Dirt | Dec 29, 2020 | 420 News, Blog, Business, Cannabis Law, Culture

By making local officials the gatekeepers for million-dollar businesses, states created a breeding ground for bribery and favoritism.

Jasiel Correia’s star was rising.

The son of Cape Verdean immigrants in the working-class Massachusetts port city of Fall River — famed as the home of Lizzie Borden — Correia was a home-grown prodigy. At 23, he was elected mayor, fielding congratulatory calls from Sen. Elizabeth Warren and Rep. Joe Kennedy.

That was in 2015. Four years later, just a week before his reelection race, federal agents ignominiously led him away from his home in handcuffs and charged him with attempting to extort cannabis companies of $600,000 in exchange for granting them lucrative licenses to sell weed in his impoverished city.

“Mayor Correia has engaged in an outrageous brazen campaign of corruption, which turned his job into a personal ATM,” declared U.S. Attorney Andrew Lelling during a press conference announcing the charges.

The downfall of Fall River’s young mayor wasn’t just a tragedy for the thousands of people who invested their hopes in him: It was emblematic of a rash of cannabis-related corruption across the nation, from Massachusetts to California to Arkansas and beyond.

In the past decade, marijuana legalization for adults over 21 has been passed in 15 states, and another 17 have legalized medical marijuana. But in their rush to limit the numbers of licensed vendors and give local municipalities control of where to locate dispensaries, they created something else: A market for local corruption.

Almost all the states that legalized pot either require the approval of local officials — as in Massachusetts — or impose a statewide limit on the number of licenses, chosen by a politically appointed oversight board, or both. These practices effectively put million-dollar decisions in the hands of relatively small-time political figures — the mayors and councilors of small towns and cities, along with the friends and supporters of politicians who appoint them to boards. And these strictures have given rise to the exact type of corruption that got Correia in trouble with federal prosecutors. They have also created a culture in which would-be cannabis entrepreneurs feel obliged to make large campaign contributions or hire politically connected lobbyists.

For some entrepreneurs, the payments can seem worth the ticket to cannabis riches.

For some politicians, the lure of a bribe or favor can be irresistible.

Correia’s indictment alleges that he extorted hundreds of thousands of dollars from marijuana companies in exchange for granting them the local approval letters that are necessary prerequisites for obtaining Massachusetts licenses. Correia and his co-conspirators — staffers and friends — accepted a variety of bribes including cash, more than a dozen pounds of marijuana and a “Batman” Rolex watch worth up to $12,000, the indictment charges.