Hemp Industry Win: Farmers Might Finally Get Bank Access

Banking has been an issue for cannabis and hemp businesses alike due to federal banking restrictions for years. But for hemp, that all could be changing very soon.

It’s safe to say that the hemp industry and cannabis industry don’t have the best relationships with banks. Because most banks are federal institutions, they have to follow federal law. This is why despite cannabis being legal in multiple state, businesses have a lot of difficulty finding a bank that will work with them.

While this will remain the case for the cannabis industry unless the SAFE Banking Act passes, the legal hemp industry has achieved another milestone in regards to banking for legal hemp businesses.

Hemp Industry Banking

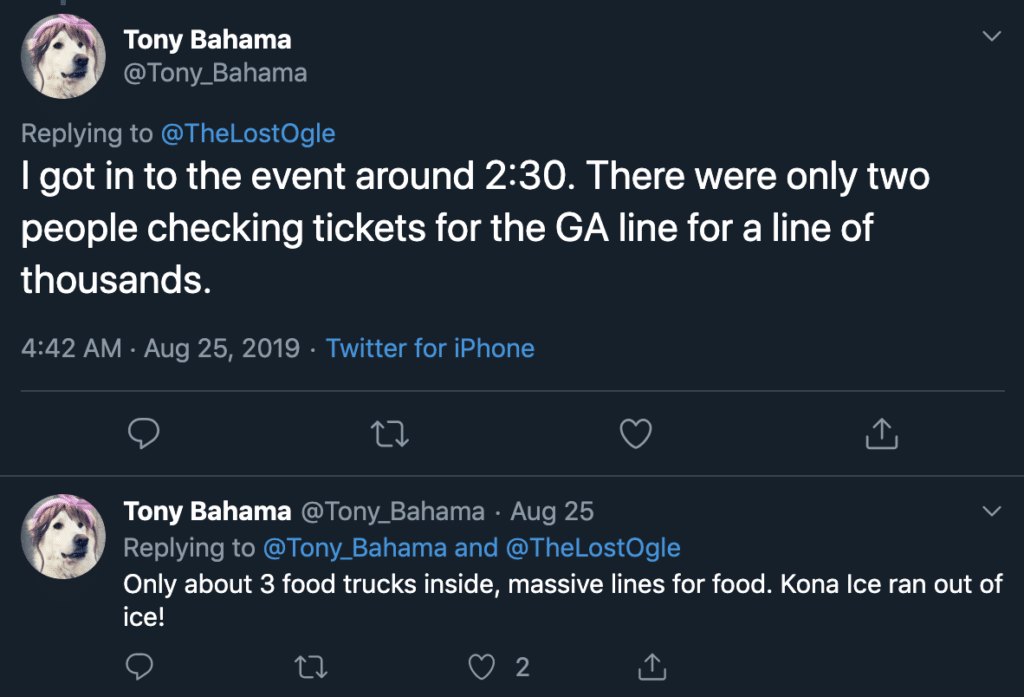

Currently, the banks that actually work with legal hemp businesses could be counted on one hand. Due to strict requirements that come with loads of paperwork, most banks just avoid hemp businesses all together. But that is all about to change.

Federal and state bank regulators announced Tuesday that they were scrapping a burdensome requirement that banks said kept them away from the hemp business. With the requirement scrapped, banks no longer have to treat their hemp customers as suspicious and file reams of paperwork to anti-money-laundering authorities for each interaction.

In other words, with less paper work and red tape surrounding the legal hemp industry, banks are about to feel a lot safer about working with hemp businesses. And it’s not like the demand isn’t there either.

In November of 2019, the American Banking Association surveyed 1,800 agriculture-focused banks in the country and found that almost half had gotten questions from their farmer-customers about whether they would still do business with them if they started growing hemp.

Hopping on a moving train

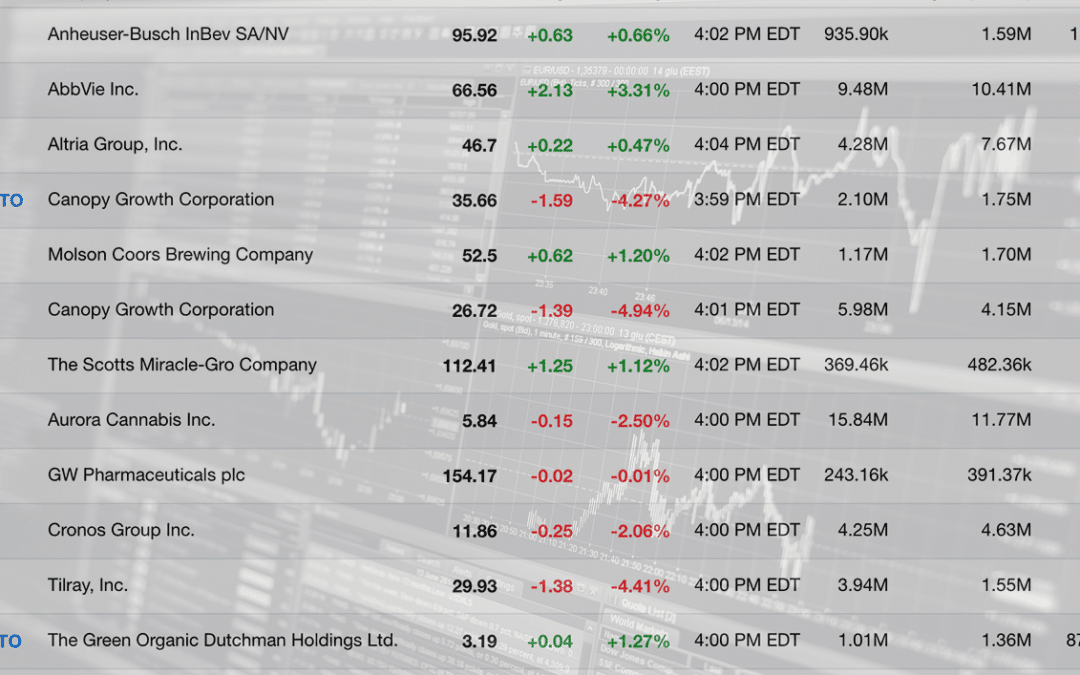

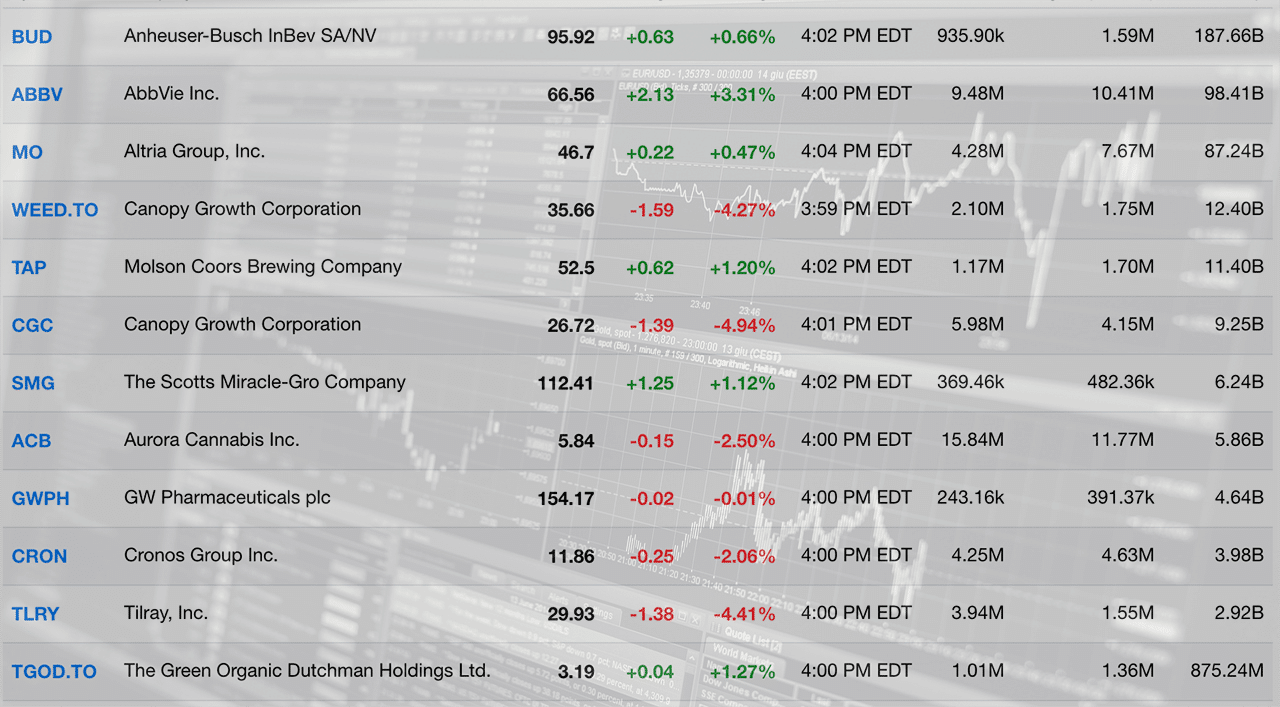

Banks have been sitting on the sidelines of the legal hemp industry and legal cannabis industry for a while now, and the industry has progressed just fine without the financial institutions up to this point. Even though banks have been slow to embrace the cannabis industry, investors have been geared up to profit from it.

Analysts tracking publicly traded companies have added pot producers to their portfolios, in order to help investors decide where best to maximize their exposure to the industry. Ultra-rich venture capitalists have begun to treat pot businesses like tech start-ups. While some stocks have had their hiccups, the industry is looking strong and projected to continue growing through 2020 and beyond.

While banks have been slow to get onboard the legal hemp industry train, hemp businesses will likely be happy to work with them now that the requirements have been lessened. Even though hemp flower producers may still find it difficult having a product so similar to federally illegal cannabis, other businesses in hemp clothing and manufacturing should start finding it much easier to find a bank that will work with them.

Is cannabis banking next?

The hemp industry is making strides on strides in terms of legalization and banking access, whereas legal cannabis industries have been inching along slowly year over year. Progress has been exponential since Colorado first legalized in 2012, with multiple states following suit in the years after. But with federal law remaining the same regarding cannabis, progress has been slow with legal cannabis businesses still lacking banking access, despite state law.

The SAFE Banking Act is currently the best hope legal cannabis businesses have to achieve banking access in the near future. While the bill has already passed through the House of Representatives with large support from the banking industry. However not many are hopeful of the bill surviving the republican controlled senate headed by Mitch McConnell.

The irony of the whole situation is that McConnell is largely responsible for the passing of the 2018 Farm Bill the federally legalized hemp across the country, yet he will also be the reason that legal cannabis businesses may not get the access to banks they desperately need. Only time will tell, and for, all the wires are silent.