As the cannabis industry expands, so do cannabis IPOs.

In other words, as more and more states legalize cannabis, the opportunity to become a publicly traded cannabis company has become enticing to many in the industry. But restrictions are fierce.

Due to federal law in the United States, no plant-touching cannabis business — regardless of its operation in a legal state — can list their business in American stock markets. Which is why Canadian cannabis stocks have become the focus of any would-be cannabis investor.

Canadian Cannabis Stocks

Being the first first-world country to fully legalize the sale and consumption of cannabis, Canada is on the forefront of managing a nationwide industry. And with a 100% legal industry, Canadian cannabis companies are free to go public. This has led to some big companies all but taking over the entire marketshare of cannabis.

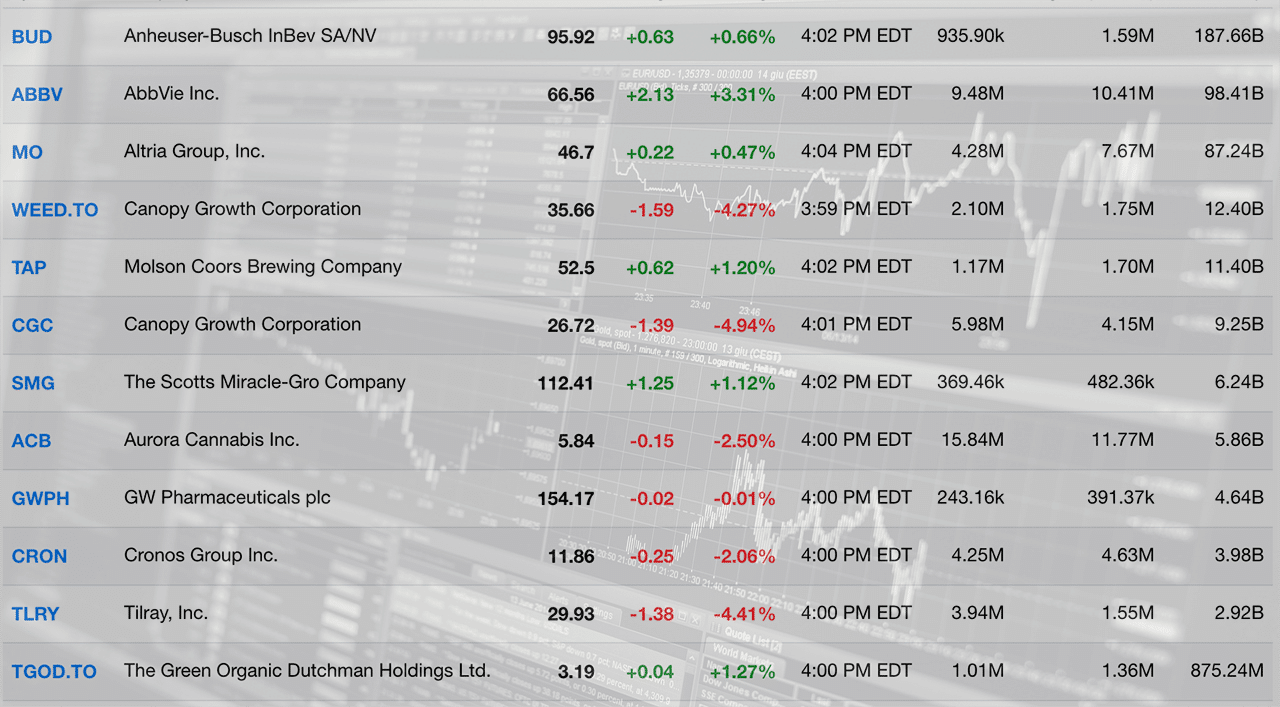

The three main competitors in Canada currently are Canopy, Aurora and Tilray. Over the last year, these companies went public with a bang, building up shares and raking in the investment dollars. But after the IPO, there has been a consistent decline in stock value for all of these companies.

While Tilray made close to $46 million in this quarter ended June 30, they still posted a loss of $32.9 million. The second place contender, Aurora is still holding strong with no reports of major losses that would impact shareholders. However Canopy, the largest marketshare holder in Canada’s industry isn’t showing great gains.

While none of these major stocks are in danger of bottoming out any time soon, the recent projections that show profitability is still some time away have some investors considering other options. This is leading to a rising interest in smaller cannabis stocks in Canada and the US.

Smaller Cannabis Stocks Rising Up

No “small” business is going to be listed on the stock exchange, which means even the smaller cannabis stocks we talk about here are still going to be relatively large businesses. It is also important to keep in mind that as big as Canada is in size, it’s legal cannabis industry is relatively small compared to the U.S.

For example, while Colorado has an average of one cannabis dispensary to every 10,000 people, Ontario has one store for every 600,000 people, and Quebec only has one store for ever 500,000. That’s a lot of people for one location to service, which means that demand is high for quality products from whoever is selling it.

While Canopy made a lot of money in the topical, oils, and edibles market, they failed to account for the demand for high-THC products, including cannabis flower. Now they are changing their strains and upping their THC content, but until that happens, smaller companies can come in and get the deals.

Companies like Supreme Cannabis Co., MediPharm Labs Corp. and Pure Sunfarms Corp. all posted positive gains and earnings this quarter. Pure Sunfarms Corp. even reported a net income of $37.2 million Canadian, which is the largest net income reported to date in the Canadian market.

What’s next for cannabis stocks

There are people who are paid a lot more money than me to determine the future of cannabis stocks, so I won’t even try to guess. What I can say though, is that Canadian cannabis stocks aren’t going to be the only option in the near future.

While plant-touching businesses cannot be listed on the NYSE or NASDAQ, ancillary businesses are all fair game in the United States. This opens the door for companies that design the containers that cannabis is sold in, paraphernalia manufacturers, and other businesses that supply equipment, legal services and more to the legal cannabis industries around the country.

Whether or not companies in these fields will list themselves is up to them, just as deciding whether or not to invest in them is up to you. But The Real Dirt will do its best to keep you updated on exciting stocks and news that you should know about the industry.