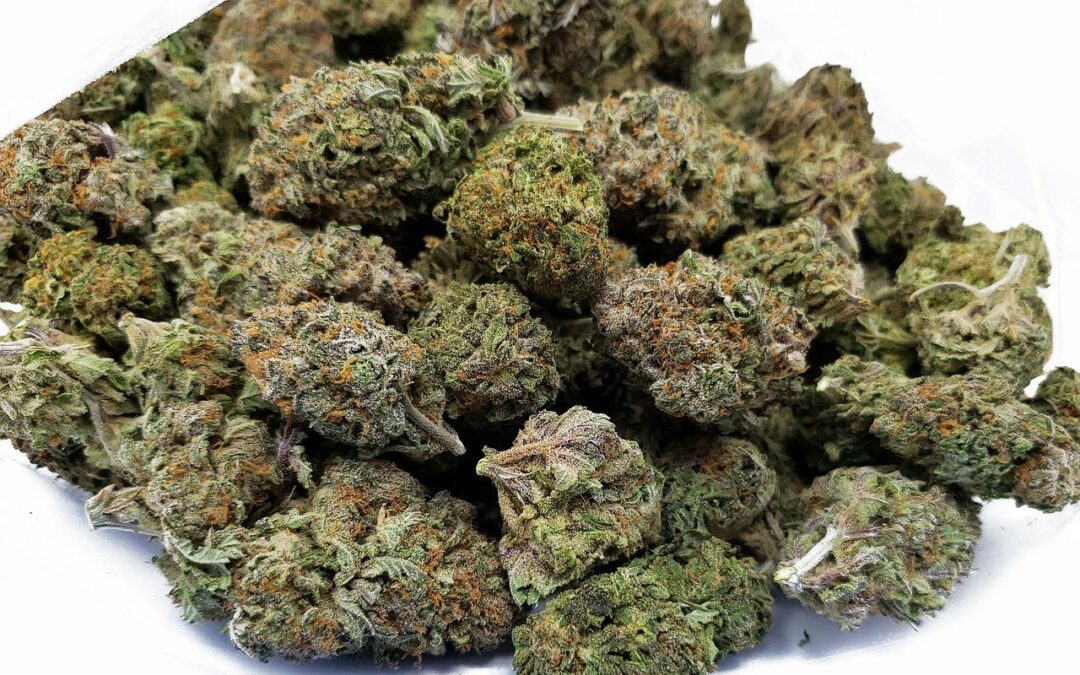

California Cannabis Tax to be Lifted to Aid Cultivators

In an effort to aid cannabis cultivators that have been hanging on by a thread the past several years, California is completely overhauling its cannabis tax codes to try and help.

The changes, which were adopted last week as part of a broader state budget agreement, will also create tax credits for some cannabis businesses, expand labor rights within the industry and switch collection of a state excise tax from distributors to retailers. That tax will pause at 15% for three years, after which regulators could raise the rate to recoup lost revenue from discontinuing the cultivation tax.

Advocates believe the new tax plan will aid the struggling small businesses operating in the legal cannabis industry in California. With exorbitant application fees, license costs and strict regulatory oversight set by local jurisdictions, it has become untenable to run a small-scale cannabis operation in the state.

While this may just be a band aid over the larger issues plaguing California’s legal cannabis industry, it should at least help cultivators stand a better chance of staying afloat in the competitive industry.

Prior to the removal of the tax, cannabis cultivators had to pay a tax of over $10 per ounce of flower. With 16 ounces in a pound, and the price of a pound of cannabis flower tanking as low as $500 in the last year, growers were potentially paying nearly half of their profit just into taxes for cultivation.

Additionally wholesale prices have dropped by as much as 50% over the past year, particularly squeezing farmers whose outdoor crops sell for less and forcing many smaller operations to close down.

Even the trimmings of cannabis plants were taxed at $3 per ounce, making a byproduct of the cultivation process that can be used to create ointments, creams or extracts just as untenable.

And of course, all of the increased costs levied on growers is then transferred to distributors, then retailers, and finally passed on to the consumer. Officials and advocates are hoping the move will lower cannabis prices overall for consumers while making it more profitable for cultivators.

However the state has yet to take any action on retail sales taxes. Business owners and advocates claim that California will never be able to compete with illicit market cannabis which is just as large in the state due to current taxes.

For comparison, alcohol in the state is only taxed at the state sales tax of 6%, with an additional charge of $3.30 per gallon. Cannabis on the other hand, in addition to state and local sales tax, is levied a 15% additional sales tax.

In other words, a customer who thinks they may be getting a deal on a $100 ounce, could actually be paying over $120 for the same product after taxes. Exorbitant sales tax on cannabis is extremely common in legal cannabis industries across the country. Medical cannabis sales in most states have no additional tax at all.

Lastly, the latest removal of the taxes is set to last only 3 years. While this gives advocates time to fight for more ground and lower additional taxes, reform licensing and equity access to the industry, the fight is not nearly over for cultivators and business owners in California’s cannabis industry.