Weed Money: Capitalism and Cannabis

Cannabis grew to the behemoth it is today only by the pursuits of those willing to risk their lives.

This makes it no surprise that as the industry grows and more regulation and legislation is introduced, a lot of older cannabis industry and community members aren’t too happy. But there’s a harsh reality that we all need to face if this industry is going to grow into a federally regulated industry.

America is capitalist. It’s a free market.

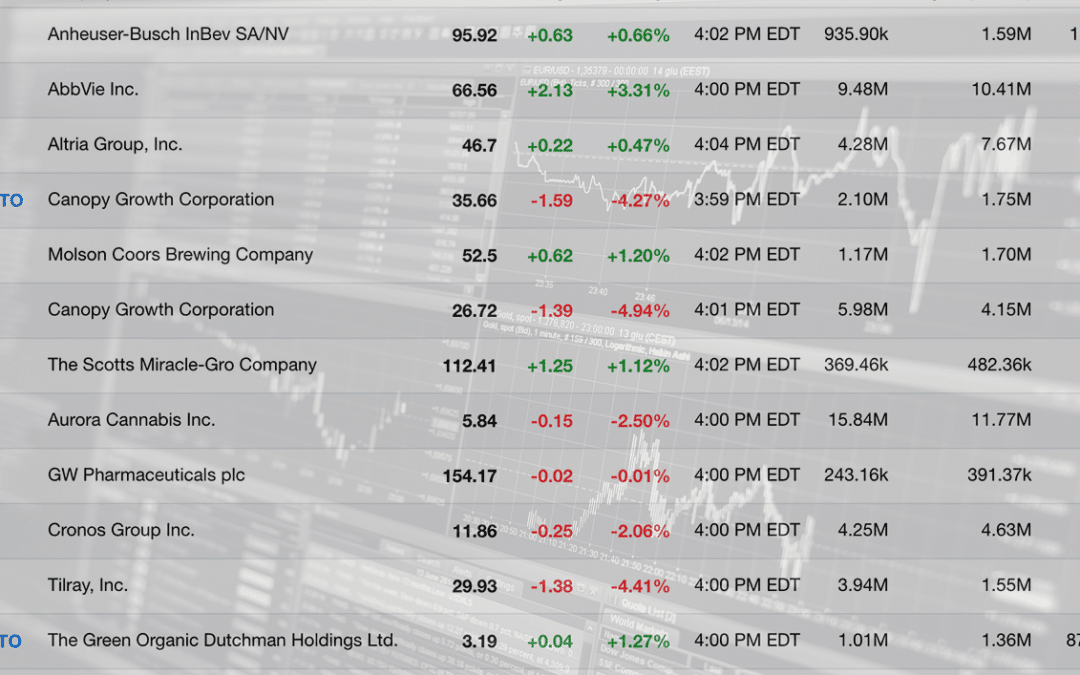

Follow the weed money

The cannabis industry was partially built on advocacy, but also greed and capitalistic intent. If growers in California didn’t push themselves to grow more and more, bigger and better cannabis every year to make more money and beat the competition, we wouldn’t have the massive variety of strains and cultivars.

And you can bet your ass that some people have gotten rich as hell off cannabis, with more and more rich getting involved like celebrities, bringing more money and investment into the industry.

When the medical industry first began in Colorado, it was a small community with mom and pop dispensaries. But as recreational came into the state, so did bigger investments, resulting in dispensary chains that knocked plenty of small dispensaries out of business. It’s clear why small business doesn’t like big business, and the cannabis industry was built on small businesses, husband and wife operations, small groups of friends building something together.

Capitalism comes for cannabis

States like Colorado and California have had several years to develop their medical and recreational cannabis industries. This means that both states are also filled with highly experienced cannabis industry entrepreneurs, ready to expand.

When a state like Oklahoma legalizes medical cannabis in 2018 with legislation that actively encourages out of state entrepreneurs to get involved, people are going to hop on the opportunity. And in Oklahoma, they definitely did.

Growers, processors, dispensary owners all flocked to Oklahoma to rent their home for 30 days in order to gain residency thanks to Oklahoma’s welcoming cannabis regulations. After they got residency, it was easy to apply and get started in the medical cannabis industry in the state. After August 2019, if you want to move to Oklahoma and start a business, you must live there for two full years before you can get residency now. In other words, if you didn’t get in before August, you’ll be two years behind.

This made a lot of industry entrepreneurs happy, but pissed off a lot of Oklahoma locals hoping to have their own local industry that now have to share it with Californians, Coloradans, Oregonians and others that left their saturated markets to start fresh in Oklahoma.

It’s a double edged sword

Capitalism has always been a double edged sword in America, which is probably why there’s so much debate around whether or not we need a new system. It promotes innovation and progress at the cost of leaving behind those that can’t compete.

Those that were once competitors that had to shut down or move shop because someone bigger or better came in, that sucks. But welcome to America. That’s capitalism, and that is what happens when capitalism and cannabis intersect.

The reality is that with a nation-wide legal cannabis industry that we want to someday achieve (even though there are plenty who don’t want that), big business is going to inevitably get involved, and small businesses will be pushed out if they can’t evolve, adapt and compete. Get an insider’s perspective on capitalism in cannabis from two long time cannabis advocates and growers, Chip Baker and Jeff from Little Hill Cultivators on The Real Dirt Podcast!