Bill filed in Tennessee to regulate and tax CBD and Delta 8 THC

A Republican lawmaker is seeking to tax and regulate the existing cannabis industry in the state.

Rep. Chris Hurt (R-Halls) filed House Bill 1690 this week. The bill seeks to regulate psychotropic hemp-derived cannabinoids, which include products that have more than 0.1 percent THC. (Current federal regulations limit THC to 0.3 percent.) That includes products containing the newly popular Delta-8 THC but not pure CBD products, which do not contain THC.

As a member of the Agriculture and Natural Resources Committee, a former hemp farmer and current co-owner of CBD ProCare — a CBD company in Dyersburg — Hurt says he filed the bill in an effort to “legitimize the industry.”

According to Hurt and Joe Kirkpatrick of the Tennessee Growers Coalition, who collaborated with Hurt on the writing of the bill, no other state has legislation that specifically taxes and limits the sale of hemp-derived cannabidiol products.

“People think that Tennessee is the last to do anything when it comes to the hemp industry,” Kirkpatrick says, “but they are forgetting that Tennessee was the first state to allow and define smokable hemp and the first state to allow the feeding of hemp to livestock.”

HB1690 would do three things: create a licensing requirement for retailers and wholesalers, establish a 6.6-percent excise tax on the wholesale of hemp-derived cannabinoids and limit sale of psychotropic hemp-derived products like Delta-8 to those 21 and older.

The bill would require retailers and wholesalers to apply for an annual $200 license through the Tennessee Department of Agriculture. Based on the licensing structure outlined, Kirkpatrick says he would expect the state to collect $160,000 annually in fees. (The legislative Fiscal Review Committee has not yet analyzed the potential economic impact of the legislation.) Licenses could be revoked or suspended at the discretion of the Department of Agriculture.

Kirkpatrick estimates that the proposed 6.6 percent tax, modeled after the tax on tobacco, could generate as much as $4-5 million in annual revenue for the state. Hurt and Kirkpatrick would like to see the money collected from licensing and the wholesale tax used to increase the resources at the Department of Agriculture to ensure product safety.

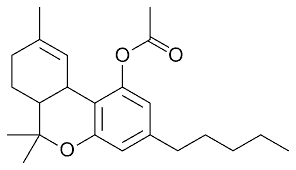

THC-O Acetate Molecule:

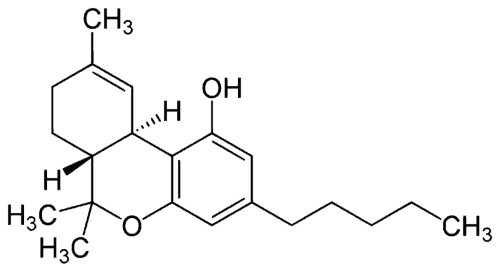

THC-O Acetate Molecule: