US cannabis jobs surpass 321,000 full-time jobs

How many jobs are there in America’s legal marijuana industry?

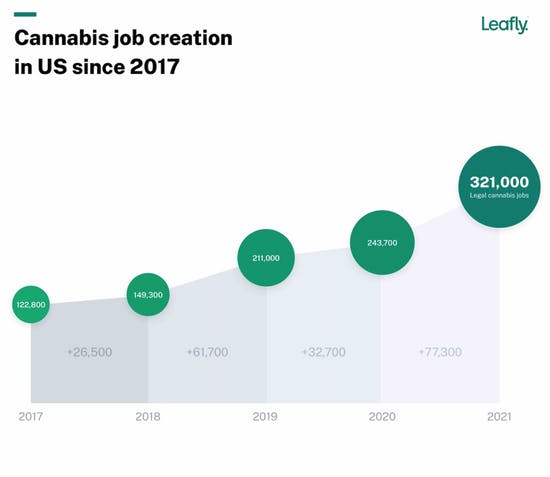

The 2021 Leafly Jobs Report, issued earlier today, found 321,000 full-time equivalent (FTE) jobs supported by legal cannabis as of January 2021. That total includes both plant-touching and ancillary jobs—everyone from budtenders to bean-counters.

To put that in perspective: In the United States there are more legal cannabis workers than electrical engineers. There are more legal cannabis workers than EMTs and paramedics. There are more than twice as many legal cannabis workers as dentists.

The annual Leafly Jobs Report, produced in partnership with Whitney Economics, is the nation’s cornerstone cannabis employment study.

Federal prohibition prevents the US Department of Labor from counting state-legal marijuana jobs. Since 2017, Leafly’s news and data teams have filled that gap with a yearly analysis of employment in the legal cannabis sector.

Whitney Economics, a leading consulting firm that specializes in cannabis economics, policy, and business consulting, has partnered with Leafly on the project since 2019.

Twice the job growth as 2019

Cannabis job growth in 2020 represents a doubling of the previous year’s US job growth. In 2019, the cannabis industry added 33,700 new US jobs for a total of 243,700.

Despite a year marked by a global pandemic, spiking unemployment, and economic recession, the legal cannabis industry added 77,300 full-time jobs in the United States in 2020. That represents 32% year-over-year job growth, an astonishing figure in the worst year for US economic growth since World War II.

Cannabis now an $18.3 billion industry in the United States

In 2020, Americans purchased $18.3 billion worth of cannabis products, a 71% increase over 2019.

When the COVID-19 pandemic hit the United States in March, many in the cannabis industry worried about a potential industry-wide shutdown. Instead, governors in most states declared cannabis an essential product. Dispensaries and retail stores responded by offering online ordering, curbside pickup, and delivery as COVID-safe options for their customers.

Customers responded by stocking up for months of stay-at-home advisories and social distancing. After a brief dip in late-March revenue, most stores saw a significant bump in April—and then the bump became a plateau.