Is Colorado cannabis industry dying or just returning to normal?

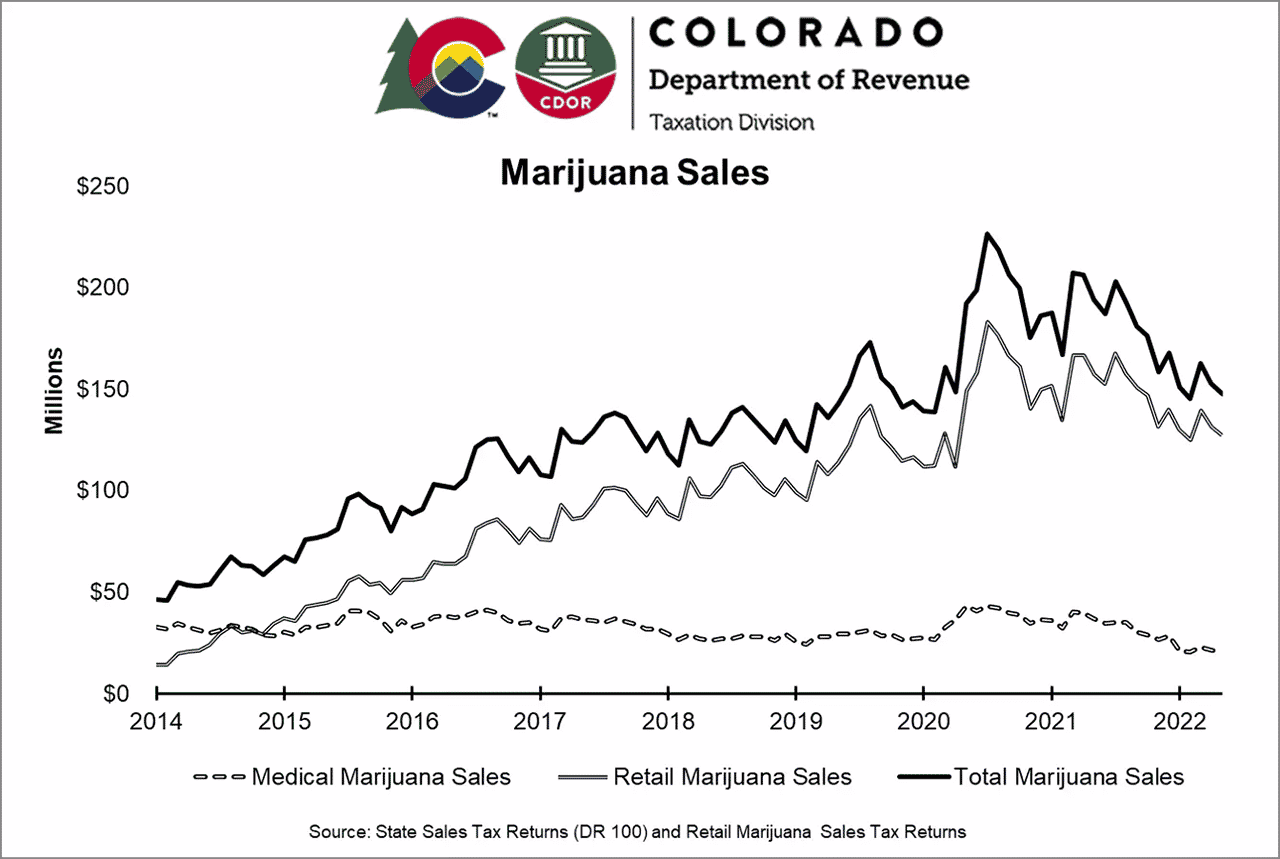

The Colorado cannabis market that thrived during the peak of the COVID pandemic has been slowly coming back down, decreasing 32% since the state broke records in July of 2020.

Colorado cannabis sales broke $226 million in July 2020 alone, setting a new record for the state. Latest state records show that total cannabis sales in the state for May 2022 were just $147 million.

At first glance this could be interpreted as the market correcting itself following the massive boost it received during the COVID pandemic. It could also be seen as the Colorado cannabis market losing marketshare following the legalization of cannabis in neighboring states like New Mexico and Oklahoma.

This answer is likely a combination of both.

During the peak of the pandemic, cannabis sales rose to record levels across the country. While many restaurants and stores shut down for months, in most states with recreational and medical cannabis, dispensaries remained open.

Cannabis was treated similarly to alcohol in this instance; liquor stores were allowed to remain open in most states during the pandemic as well.

The picture of Colorado’s cannabis industry profits becomes less pessimistic when taken in context and compared to pre-COVID numbers. However the numbers still show an industry that is struggling to grow as the national industry also grows and consolidates.

For comparison, let’s take the same month that we can consistently track according to state released data; May.

In May 2019, total Colorado cannabis sales were $143 million. One year later in May 2020, the state sold over $192 million in cannabis, which would gradually increase month by month until the record breaking month of July 2020 ($226 million).

It is easy to see the boost that COVID gave to cannabis sales in Colorado, as in May of 2021 sales were back down to $194 million. This number is just $2 million more than the same month in 2019.

Comparing to 2019 and removing 2020 from the equation, May 2019 to May 2022 show almost no growth.

Coincidentally, July 2021 was also one of the most successful months of the year, selling $202 million in cannabis products. The industry has not broken $200 million in sales since then.

As an additional comparison, we can look at the same 5 month timeframe from this year (2022) and last year (2021), from January to May.

The mean cannabis revenue in Colorado in 2021 from January to May was $192 million.

The mean cannabis revenue for 2022 is $151 in the same time period.

For a pre-COVID reference, sales for the same period in 2019 were only $133 million.

In other words, while Colorado cannabis sales are down compared to previous quarters, the industry has overall seen growth. The boost the industry gained from COVID has had residual impacts, with more people still purchasing cannabis than before the pandemic.

However the state has not seen a booming month like July 2020 for some time. Current trends in the industry hint that it is unlikely the state will see sales numbers surpassing $200 million until the next holiday season, if ever again.