USDA Releases Final Ruling on Hemp

From sampling to THC testing, here’s a rundown on how the final rule, which takes effect in March, compares to current regulations.

On Jan. 15, the U.S. Department of Agriculture’s (USDA’s) Agricultural Marketing Service (AMS) released a final rule on hemp based on its previous set of regulations that drew public comments from nearly 6,000 people.

The latest set of regulations makes several highly requested changes to the interim final rule (IFR) that are seen as favorable to both hemp producers and regulators.

Still, contentious aspects of the IFR remain, but some industry members are hopeful there is still time to amend them.

Sampling

The final rule made several changes to sampling that should reduce burdens on both growers and regulators.

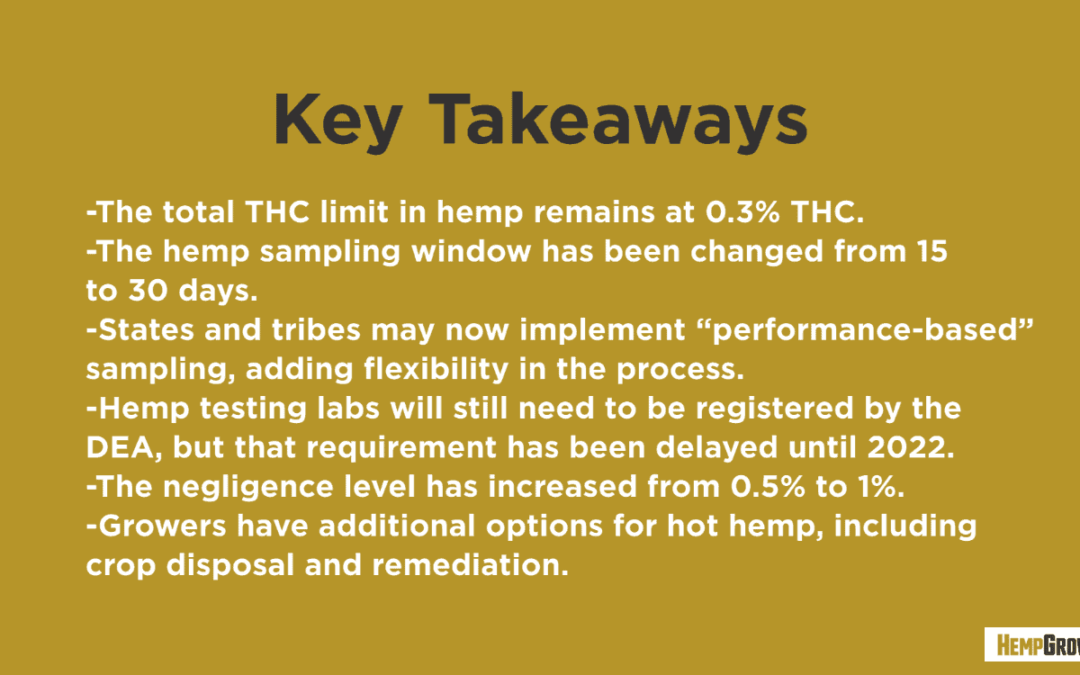

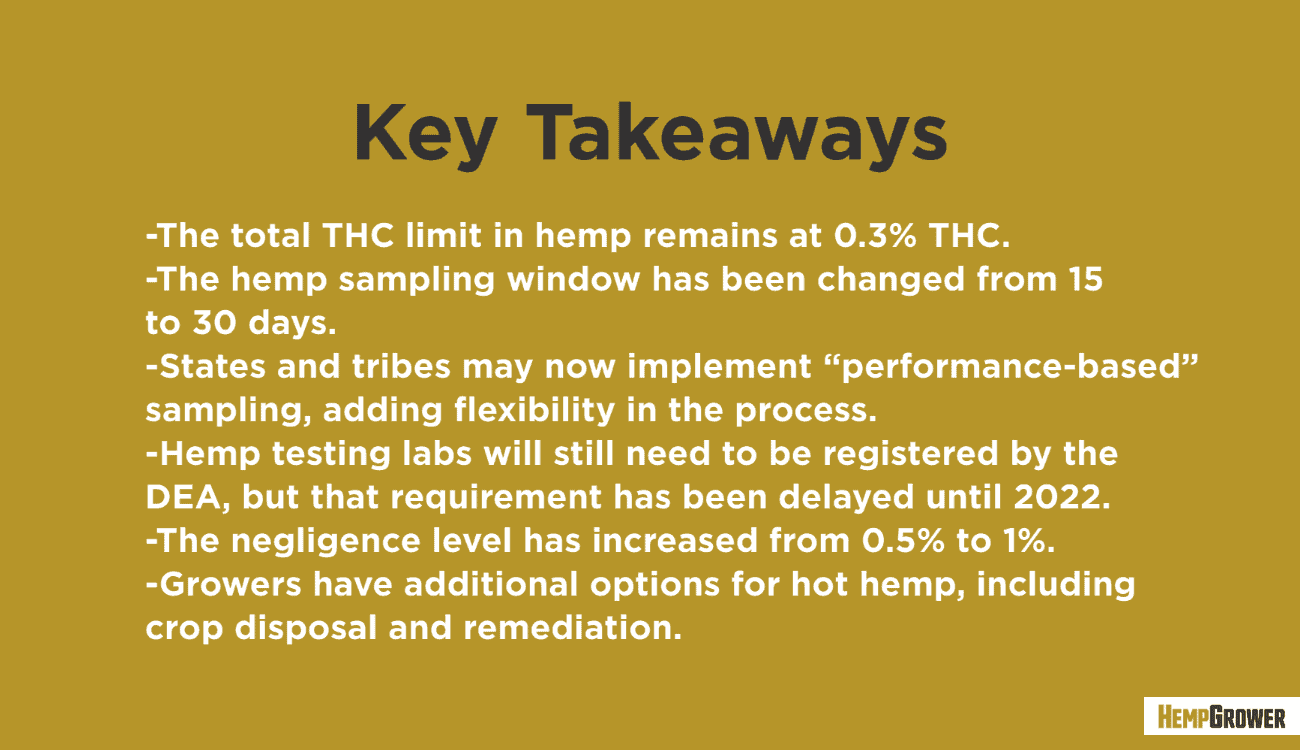

First, the rule increased the sampling window, which is currently 15 days. Samples for testing now need to be taken up to 30 days before a farmer plans to harvest, giving regulators more time to get into fields. Many stated in public comments that 15 days was far too little time to collect an appropriate amount of samples from each producer in the state.

The rule also slightly modified from where on the plant samples need to be taken. While the IFR required collecting a sample from the top third portion of the plant, the final rule now states samples should be taken “approximately five to eight inches from the ‘main stem’ (that includes the leaves and flowers), ‘terminal bud’ (that occurs at the end of a stem), or ‘central cola’ (cut stem that could develop into a bud) of the flowering top of the plant.”

Andrea Hope J. Steel, the director at Coats Rose P.C. and co-leader of the law firm’s Cannabis Business Law group, tells Hemp Grower this provision will allow sampling agents to collect more stem and leaf material than previously allowed.

“That will help reduce instances of hot crops,” Steel says. Stems and leaves typically contain lower levels of cannabinoids—and specific to this issue, of tetrahydrocannabinol (THC)—than the flowers.

However, Graff says this still requires sampling from primarily floral material despite comments on the IFR that requested switching to a whole-plant sampling approach.

The final rule dedicates a significant portion of its 300 pages to addressing and responding to the most highly requested comments, including those on sampling.

“Even though many commenters felt that whole plant sampling should be allowed, AMS is of the opinion that since THC [tetrahydrocannabinol] is concentrated in the flower material of the plant, the flower material is more appropriate to test than the entire plant,” the final rule states.

Perhaps most significantly, the final rule has changed sampling protocol from collecting a “representative sample of every lot [growers] plan to harvest” using specific methodology, according to the IFR, to allowing states and tribes to implement a more “performance-based” method.

The AMS says these performance-based sampling protocols may take into account:

- seed certification processes (or other processes that identify varieties that have consistently produced compliant hemp plants);

- whether the producer is conducting research on hemp at an institution of higher learning or that is funded by a federal, state or tribal government;

- whether a producer has consistently produced compliant hemp plants over an extended period of time;

- whether a producer is growing “immature” hemp, such as seedlings, clones, microgreens or other non-flowering cannabis, that does not reach the flowering stage;

- other similar factors.

“Flexibilities afforded to States and Indian Tribes developing their own hemp production plans will allow them to incorporate best practices, as those change and develop over time. For example, States and Indian Tribes can adapt field-walking patterns to various sized and shaped hemp grower operations,” the final rule states. “AMS believes that a national standard would be difficult to consistently apply given the various grower operations and that standard ‘zig-zag,’ or letters ‘M’ or ‘Z’ walk patterns may not be feasible for sample collection of micro-acreage producers, very large scale producers or those with polygonal hemp lots.”

States will need to include details of their performance-based sampling methods in their hemp plans, which the USDA must approve. (An updated guide on sampling has been published on the AMS website.)

Testing

While the final rule implemented generally positive sampling changes for the industry, THC testing will, for the most part, remain burdensome.

The final rule retains that hemp must remain below 0.3% total THC on a dry-weight basis. Total THC is defined as the sum of the delta-9 THC and tetrahydrocannabinolic acid (THCA). On its own, THCA does not produce psychoactive effects like delta-9 THC, but it can be converted to THC through decarboxylation, which is the process required for testing.

While increasing that limit was one of the most highly requested changes in public comments, the USDA was unable to do so, as that limit was written into law in the Agriculture Improvement Act of 2018 (the 2018 Farm Bill). It’s notable that total THC, however, was not written into the farm bill—that bill defines hemp only by delta-9-THC levels. In its final rule (as well as the IFR), the USDA interprets the language of the farm bill to mean that total THC must be tested.

However, legislation has been introduced in both Kentucky and at the federal level by Sen. Rand Paul to amend that limit to 1%, which would quell the total THC versus delta-9-THC debate.

Options for Hot Hemp

If hemp does test “hot” above the 0.3% THC limit, the final rule has given producers additional options for disposal beyond the total destruction written into the IFR.

States now have several options for more productive and less wasteful methods of disposal that can result in useful soil amendments. Those include:

- plowing under

- mulching/composting the hemp

- disking

- shredding the biomass with a bush mower or chopper.

Producers may also bury or burn their hot hemp. (The AMS implemented these additional options in early 2020, but they were not written into the IFR.)

The final rule also implements a brand-new option for hot crops: remediation.

The rule states producers can remediate their material by “removing and destroying flower material, while retaining stalk, stems, leaf material, and seeds.” Producers may also shred the entire plant to create a “biomass-like material” and then retest it for compliance.

Producers also no longer need to use a DEA-registered distributor or law enforcement to dispose of hot hemp.

Read the Full Story from Hemp Grower Magazine