What’s misunderstood about the MORE Act

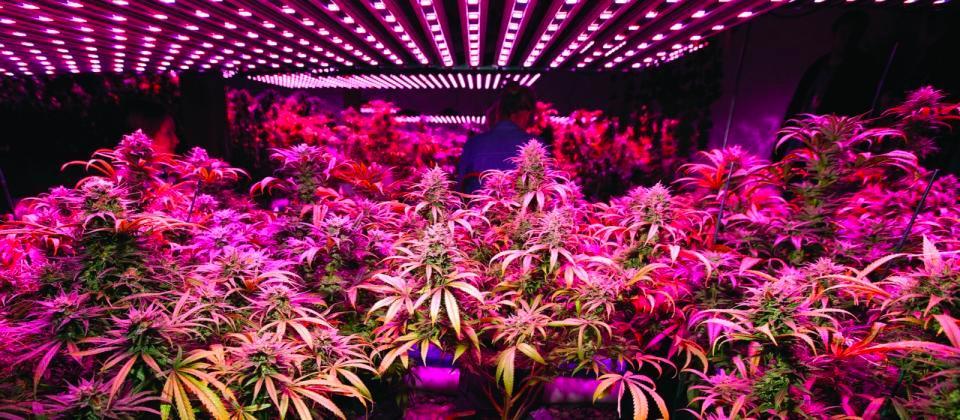

The measure wouldn’t create a federal licensing or federal regulatory framework. States would, however, continue to regulate marijuana as they see fit, without federal interference.

“The MORE Act decriminalizes and deschedules cannabis,” said Randal Meyer, the executive director of the Global Alliance for Cannabis Commerce.

“It would allow state-legal businesses to operate in a federally legal environment, with business-tax deductibility and access to legal processes, and permit states to set their own cannabis policy, be it total prohibition or not.”

Steve Fox, strategic adviser to the Cannabis Trade Federation, said: “The MORE Act is a wonderful piece of legislation that would end cannabis prohibition at the federal level and take some critical and much needed steps toward restorative justice. It would provide major benefits to cannabis businesses, which would become legal at the federal level.”

Businesses, he said, would have greater access to financial services and be freed from Section 280E of the federal tax code, which currently prevents marijuana companies from taking deductions for ordinary business expenses.

“The MORE Act does not, however, establish a regulatory framework for cannabis at the federal level. So, from an industry perspective, the MORE Act is just one step in a longer process,” Fox said.

Vincent Sliwoski, a cannabis attorney at Harris Bricken in Portland, Oregon, echoed Fox, noting that licensed marijuana commerce will remain in place unless changed by states or local jurisdictions.

“What the MORE Act actually does is remove marijuana from control under the federal Controlled Substances Act while adding a 5% federal excise tax and tacking on key provisions like expungement for past marijuana convictions under federal laws. As with alcohol, there will be no federal business licensing element.”

He also emphasized that there would be “a lot of benefits here for state-licensed cannabis businesses, including everything from banking options to tax relief under (Internal Revenue Service) code 280E to federal trademark availability.”

Experts also note that they expect a number of federal agencies, such as the Food and Drug Administration, the Federal Trade Commission, the Department of Treasury and the Department of Agriculture, to weigh in on various issues, including health claims, cultivation standards and banking issues.