Transcript:

Chip

This is Chip Baker with The Real Dirt podcast. We’re back again. Wow. It’s been a long time since we put out an episode. But we got a lot of important things going on in the cannabis industry and we felt like this was the perfect time to get back into it.

You know, today it is July 10 2022. I’m in Denver, Colorado. We’ve been spending time all over the country, but primarily in Oklahoma this past year. And it seems that the state of the cannabis union is really in flux right now. You know, with the economy with inflation. With post COVID You know, structure of business and in life, the cannabis industry is really taking a turn. Today I have Jessica Baker as my guest. Jessica owns and operates a series of cannabis businesses in Oklahoma. Welcome, Jessica.

Jessica

Thank you for having me on the show, Chip. Always a pleasure to talk to you by cannabis and cannabis business.

Chip

Just to introduce yourself a little bit. I know you’ve been on the show before. And many people know you as my wife, but you are a incredible entrepreneur and educator. And let’s just talk about Jessica for one song moment. Okay, great.

Jessica

Thank you for the introduction. I am your wife gladly. But I’m also an acupuncturist for the last 15 years and a Western herbalist for the last, you know, two decades plus, so I have well versed in, you know, Chinese medicine and Western herbalism. And also I own several cannabis businesses. I’ve been growing medical cannabis since 1997. Back in the good old days, and so probably grown a lot of different ways. Not every way. But I’ve definitely dabbled in growing in multiple different modalities. And I own a clone nursery in Oklahoma City, as well as cultivation and processing facility. And so we’re kind of do a little bit of everything. And yeah, I love cannabis. And I love your show. Well, thanks, Jessica. And you know, I really appreciate all the women weed warriors out there, you know, this industry is is filled with dudes and dudes often try to dominate, uh, you know, whatever we’re involved with. That’s just the dude power. But, you know, we know so many women, cultivators, women, extractors, women, business owners, and the you know, I get to see it throughout the industry. I see. Maybe you call it discrimination against women business owners, just as we see it in the rest of society. But man, you know, if if the women that you know, in the cannabis industry, I guarantee you, they’re working twice as hard as the dude right next to them. And if you have a problem, you should go like maybe chat with the women that you know, in the cannabis industry and see how they feel about what’s going on. Because often they do have a different perspective than our dude oriented industry.

Bro science.

Chip

It is bro science. But yeah, we’re here today to talk about the cannabis industry. Boy, it is in a tailspin. Every aspect of the cannabis industry from the manufacturers and the suppliers of all the equipment, transportation, all the cultivators, the distributors, the the grocery stores, the dispensaries, like everybody is really filling this economic depression right now. Jessica, how has it been an Oklahoma what’s going on there?

Jessica

Oklahoma has been, you know, an interesting market to say the least when we first got there, you know, three plus years ago, it was a very immature market in terms of the knowledge surrounding cannabis was pretty limited to you know, the little bit of, of knowledge that people have gained over the years from, you know, the private market, which is always amazing, but the strain names and things like that really weren’t, hadn’t quite hit Oklahoma yet. But now, you know, it is pretty much you’re hearing the same things as you’re here in Colorado and California in terms of growth techniques, terminology, and cultivars that are now popular in Oklahoma. So I feel like I’ve really seen that change and people get really enthusiastic about cannabis. And so you know, the last year we’ve definitely seen especially at the clone nursery, a lot of the big cultivators aren’t buying clones, like they have been the two years previously. A lot of people that were maybe larger Cole debaters came in and bought less clones, because their facilities that were 1020 30,000 square feet, they, maybe they didn’t have the knowledge to pull off that large of a grow at the very beginning. So they were like, Hey, I’m going to scale back, learn a little bit more about it. And then I can always scale up again in the future. And then I know people who, unfortunately, you know, maybe they had a 401k They took out or some early retirement or some other personal investment to invest in cannabis, and it didn’t work out for them. And now they are cultivating anymore, either their want to sell their licence, or they are just kind of letting it stay dormant for a little bit.

Chip

Tell us about like, what you feel about the number of cultivators that in Oklahoma that are cultivating this year, or number of businesses that maybe have like gone out of business or just aren’t operating?

Jessica

Well, I only know a handful of those, but I can say it’s all across the board, from dispensaries to processors to cultivators, I’ve heard a little bit from all of those sectors, saying that they’re they’re taking a break, or that they just downright are going back to their job at the, you know, do an oil rigging or we know whatever it is, I don’t think that’s the proper terminology. But you know, they’ve just decided they’re gonna go back to what they were doing before, right, or what they never stopped doing, you know, and they were doing cannabis on the side. And so, yeah, it has been significant. I know that, you know, where we’ve heard stories about when metric came into, into law at the end of May, that a lot of people never signed up for metric that actually had a licence. And so maybe they were going to do that later. Or maybe they just decided, well, I’m out now that there’s more regulation and work to be done to you know, how to leave or business

Chip

To catch up on in Oklahoma. They’ve had a series, one, if you don’t know really was a free for all until recently on getting licenced and started cultivation in Oklahoma. But in the past couple of months, we’ve had a series of things going on between changes in the law, moratoriums and the licences requirements for metric tiered licencing. And it has reduced the number of people in the industry, right? Some people just didn’t want to deal with it, or they were barely making any enough revenue to support their hobby, so to speak.

Jessica

Yeah. And like, oh, MMA, the Oklahoma Medical Marijuana marijuana advisory or stands for something like that. We’ve had a couple of inspections. Now it took it took a couple years or more, but we finally have been starting to get inspected. And our inspectors are telling us that, you know, they’re going to places that are not operational. So a lot of places still have a licence, but they’re not operating.

Chip

And we haven’t touched on to the elephant in the room, but it is about the decrease in price.

Jessica

Oh, 100%. It has to do with also the decrease in profit margins for people. Right.

Chip

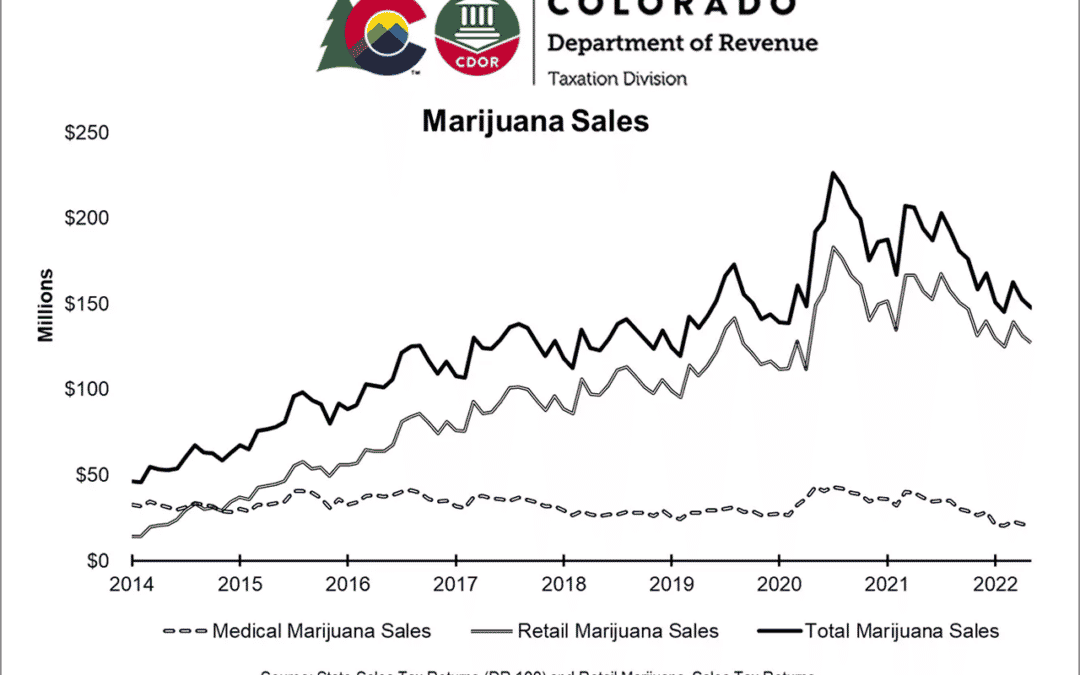

Right. Right. Yeah. You know, it’s not just Oklahoma, across the country, people are having these, you know, this, this decrease in cost per pound cost per gramme from the wholesaler to the distributors to the manufacturers. Everybody has their theory on why you think this is. And some people say it’s just simply supply and demand. I believe it goes a little bit deeper than that. But why do you think the national price of cannabis has gone? So it has dropped so much? And why do you think it’s dropped so much in Oklahoma?

Jessica

I think it has dropped nationally, because there’s just so much cannabis being grown and a lot of states that never were legally allowed to grow before. And I think with metric or not, I think there are still ways that people are probably putting that on the private market, even though they’re meant for the public market. But I think there’s just a glut and cannabis. I know people regulated market, the regulated market, right. So I know that there’s a glut of you know, cannabis in Oklahoma, and Colorado and California. And in Oregon production, overproduction. People still are sitting on hundreds or 1000s of pounds from last year. And now they’re like, growing again this year. So there’s going to be even more on the market.

Chip

Do you think this is overproduction in the regulated market or the illicit market?

Jessica

Probably both both. But yeah, I would say both.

Chip

Yeah, farmers mostly have one. You know, one business plan and we talked about this many times on The Real Dirt is prices down, grow more, prices up, grow more. And that’s really what’s going on and you know, there was just such this huge decrease increase in demand for cannabis products, you know, 2020 2021 And it’s a fact unemployed people consume more wheat, right? They unemployed people smoke more weed. Right? So, you know, all those people have gone back to work right now we’re at the lowest unemployment rate, you know, the country’s one of the lowest the country’s ever seen like everybody’s back at work, but the economy is not so great.

Jessica

And if gas is $5 a gallon, and you have to make a choice between buying your Eight for the week or your ounce for the week, or continue to put gas in your car to get, you know, to work and everywhere else you’re going, then you may have to sacrifice by spending less on cannabis

Chip

Or many people walk. Many people don’t have that option. Yeah, how many people unfortunately, transportation options, but you know, that recreation is one of the first things to go. And you know, they say that, like the vice industries are recession proof, but it’s just not true. As as we see it now, if people just don’t have the money to spend on it, you know, and cannabis isn’t like coffee, or alcohol, right? People really need that coffee and alcohol. And most people can just like do without we, they might want it. But they can do it out do without it. And it’s similar to the cleaning business we were talking about this earlier, is, you know, one of the first ways that farmers can cut their costs is by not buying clones. And you know, one of the one of the things that I see, you know, farmers use clone nurseries for is when they can’t fill up their fields, they can’t fill up their rooms, and they come to clone nurseries often in an emergency situation. Absolutely. I see that. And they say, you know, oh, my clones died or

Jessica

Yeah exactly my clones died, or I bought clones apartment out or

Chip

and it’s often because they need to fill up that room. Yeah, but many people are shutting down lights, they’re shutting down greenhouses.

Jessica

Their rooms are getting smaller. They had, you know, eight rooms and a 20,000 square foot facility and they’re gonna run two of them. Right? That’s where they started their own moms. Right and took clones, right, you know, but most of them still come back saying my clones didn’t work out. I need more. You know, we can all we always need more, you know? Not always but

Chip

Yeah, totally. But no, we we know several people who have shut down parts of their business, you know, and aren’t cultivating any longer because they can buy cannabis cheaper or as cheap as they can produce it. And so now in their dispensaries instead of buying a built making in house, they’re buying it on the market.

Jessica

Yes. Yep. I see all of that.

Chip

What about this overproduction that’s been going on in Oklahoma.

Jessica

So you know, the overproduction in Oklahoma is twofold. One, and just to be frank, it’s okay. To be frank, a little bit about the overproduction of Oklahoma, is that a lot of the cannabis just isn’t really that great. So you have inexperienced growers growing outdoor in a really harsh environment. Yeah, or a greenhouse or greenhouses, you know, in harsh environments. And so it’s kind of sub quality weed. And so that’s one reason why the price is so low,

Chip

because when the market is flooded with whatever it is, the price does drop, but it drops that lowest common denominator with the quality of the weed being

Jessica

exactly and I think a lot of people, outdoor growers and greenhouse and even indoor, they know that they’re just growing for extraction, and that their quality is only going to be extraction material anyway. And so there’s this large volume of only things that they know will only go to the extractor, so the quality doesn’t have to be there,

Chip

right but then somehow that extractable quality weed still ends up in the flower market. Oh, absolutely. Right, because there’s just 1000s and 1000s of pounds. Do you have an estimate of how much nobody even knows how much wheat was grown in Oklahoma?

Jessica

I can’t even try to guess but I mean hundreds of 1000s of pounds million. I don’t even know what 2 million so I think that’s part of it. And then I also think that

Chip

Hey right now, if people are listening to this, we’re definitely getting some responses about how Oklahoma was fucking up the market for everybody else. But that’s

Jessica

just not true because California and Oregon have waived for cannabis and Oklahoma even has because there’s more people and it’s better quality and it’s still going for super cheap. And that has nothing to do with Oklahoma’s outdoor and non regulating the amount of plants you can grow.

Chip

Yeah, so you know talking to people around the country we still see the most cannabis both regulated and you know A private market cannabis is coming from California and Oregon.

Jessica

I mean, California, of course.

Chip

Right. It’s just pot the seed over there. Yes. You just put it in the ground and it grows great. It’s not like that anyplace else in the country. Absolutely. So we got in Oklahoma, we’ve got an overproduction issue, we’ve got inflation issue. And we kind of have a regulatory issue that’s occurred here, too.

Jessica

But you know, the other thing we have is the fact that a lot of people with no knowledge or history of being in cannabis, or business, or business thought that it would be easy money to get into cannabis. And then three years later, they’re realising that’s not actually true. And so I think that’s a large part of it too.

Chip

Getting rich quick since 86.

Jessica

Yeah, I mean, I love you know, it is what it is. But I think

Chip

that also because, at least at Oklahoma, it’s not get rich quick, is it? No,

Jessica

it’s absolutely not, you may have some couple of great harvests and think you made some money. But, you know, you never know.

Chip

You know, few people can do this number, where they like, enter the market, get a bunch of weed, make a bunch of profit, and leave and exit the in and out hot potato business strategy, right people that just doesn’t work for No, absolutely. There’s this just dream. And what happens for most people is they put all of their retirement. All right, exactly. 101 K, you know, their friends, money, their grandparents, whatever, whatever investment, they use it, right, because they’re inexperienced, they may love weed, they may have grown wheat all of their life, they may grow great weed, but none of that matters in commercial sales, commercial production. You know, when the price drops so low, you have to know how to grow that cannabis as inexpensive as possible, but still remain the highest quality,

Jessica

Absolutely absolute, but most people, especially with how low the prices are right now, even for indoor and a lot of places. It’s really, you have to know how much it actually cost you to grow per pound, to make sure you’re not actually losing money on every pound that you sell.

Chip

Yeah, absolutely. In many people, you know, there’s this struggle because people so many people think that like you’re reducing quality and blah, blah, blah, but but so much of it is just organising the space, time and materials, right and people, right, and if you can organise space time materials and people like you will, like have the most efficient operation that you have that you can get a no matter what technique you’re growing under. But when you’re able to do that, then you will reduce your you know, your cost of good your overhaul cost. In hey, let’s talk about that. Jessica, what do you think the breakeven cost of production for farmers should be your needs to be for, for people to continue to stay in the industry or cultivators?

Jessica

I mean, that’s hard to say if you are just talking about you’re growing for extraction, and Oklahoma pounds for extraction go for about 50 bucks a piece. So if you’re growing cannabis for under $50, and then you know and that’s your entire cost of labour and you know,

Chip

You’re gonna grow it for extraction in Oklahoma,

Jessica

then you better be growing it for $25 or $5 of have me just hard to

Chip

do right because of the manual labour associated with harvest mostly manual labour associated with planning till the irrigation can be put together what but what about indoor?

Jessica

I mean, indoor again, I’ve seen the indoor for as low as $500 in Oklahoma, and these you know, I don’t know if they’re truly selling indoor if they’re just calling it indoor, it’s hard to say. But I’ve seen what they call indoor that does not look that great.

Chip

We see this throughout Oklahoma, and we’re unsure if it’s just, you know, nice greenhouse operations, poor operators indoors. Yeah, I don’t know. Yeah, we don’t quite know.

Jessica

But I know I’ve seen it. You know, I’ve even seen $350 pounds of indoor with somebody that claims they have a 50,000 square foot facility.

Chip

We have seen those prices in Colorado to hurt them. I don’t think that’s the average price. But those are the lows. What do you think people in Oklahoma or? I’ve heard you sing for the like, how much does it cost to produce it? That’s what I’m asking.

Jessica

I mean, I honestly don’t know for people because I don’t know. So you have to Yeah, okay, you know, because I don’t know what they owe on the building they’re growing in are they paying back investors every month for part of this grow? Or if it’s, you know, they own the building

Chip

for $500. Then like, you know, like you got to indoor specifically, they’re either liquid needing to get rid of round is how much it’s gonna cost, right? Yeah. Like if you’re the one of the best operators in the country, you got all your shit together, you might be at 250 pound indoors, and some people can do it even cheaper. And that’s trimmed all your cost of production in the bag. Yeah, most people it’s not that much money. It’s 450. It’s 750. It’s, it could be $1,000 For some people, and it doesn’t matter how great the weed is.

Jessica

I mean, I’m still hearing some rumour. There’s a couple growers in Oklahoma claiming they’re still getting 2000 and door lb, I have yet to see that. I’m sure that exists. I get but the emails I get, they’re not selling for that much. 50.

Chip

So there’s the other thing we talked about, about pricing throughout the country, too. And now what’s even worse, is these emails and texts, often I feel like you’re just driving the price down. And so much of it’s fictional, right? There’s nobody that has the operation that needs 1000 pounds a day or you know, it’s just fictional in order to drive the price down or to manipulate the market or just people fucking around.

Jessica

Well, and these brokers don’t even get me started on like, how they lowball and then still try to get the same price because at one they in Oklahoma, none of them had a licence to be doing that anyway.

Chip

Yeah, they you know, they shouldn’t be called brokers. They should be Hey, pardon me, all brokers out there. They’re really nice and honest, dudes. They shouldn’t be called brokers. They should be called hustlers.

Jessica

Yeah. Well, we always tell the middleman and we really never liked unless they were helpful and actually, like, not just trying to rip off the growers.

Chip

Well, you know, what I’ve seen between old days in these days, and distributors and brokers is old days, it was like a set like, Hey, I’m gonna get $50 or $100 a pound.

Jessica

Now they want as much as the grower made.

Chip

Yeah, exactly and they’re just trying to lowball the grower to get that price down so much. And then the bad part is, it’s usually not even their money. So it’s often this like, you know, fucked up deal where they’re truly middleman, someone else has the money. Right? And, you know, they’re like,

Jessica

they’re acting like they have some inside knowledge into the weed space.

Chip

They should be connection and they should be paid for that connection. Don’t get me wrong, but like, I don’t know, if you want a sustainable business and you really wanted to clean up like, you know, having a reasonable brokerage fee. You know, I mean, hell, what a, you know, like,

Jessica

but you can’t be trying to make $200-300 a pound you’re buying for $500 or $400. Well, not only that,

Chip

but like your seeds right now. I know. But hey, man, you’re gonna go they’re gonna go out of business right now. Or your your profit definitely is gonna change.

Jessica

Yeah, absolutely. As it should. Because I mean, once again, the farmers are always the ones who take the hit.

Chip

Yeah, let’s talk price structure. That’s a great way to do it. Alright, so we’ve been taught cost to production, but like farmer sells the pound for 500 bucks. Let’s just say $500. He sells it to a dispensary direct. Right? dispensary sells $100 ounces. They make $1,600. dispensary sells $75 ounces. Right. They’re making 12 hundred bucks.

Jessica

But then 40% of that goes to the tax man because of you know, the

Chip

well 40% of the profit. So not 40% of the sale. Right. Right

Jessica

or 40% ofthat profit goes to the taxpayer. Well, that goes to the feds. And then if you’re in Oklahoma City, 15.5% of that immediately goes to

Chip

passed on though it’s usually not out the door pricing on what I’m talking about. Sometimes it

Jessica

In Oklahoma they really like out the door pricing

Chip

Yeah, but this just is just not the standard, you know. And so basically what I’m saying you’re buying it for 500 bucks, you’re selling it for 1600 bucks, you’re making $1,100 profit and then 40% of that should go to the man which is about 400 and something dollars. So like, now you just made the six $700 on a $500 lb there’s still quite a bit of money going on with dispensaries.

Jessica

Absolutely. But I mean, especially in Oklahoma, man, you’re seeing three ounces for 150 bucks and unit Yeah, but that’s greenhouse or outdoor we No, I’m just saying that like, I’m not seeing the high priced in Oklahoma. I don’t see as much of the high price than you used to. So I do think in some respect, those profit margins may not be as high but I’m sure they’re still high for a lot of places.

Chip

Sure, sure. And then a lot of those places are produced a lot of you know, if you’re producing the cannabis and you’re selling it, that’s the best deal you got going if you can grow it cheap enough? Yeah. Right? If you can grow it for 500 bucks or $700 a pound inside, and then resell it for that that’s decent money. That’s really good, good money. But I guess my point is this is that restaurants, farmers, entrepreneurs throughout the world operate on 10 and 12%. Net profit. And it just takes a skilled business person to operate in that manner. And you’re still making money, as the dispensaries right at these at these low prices, you have to get the customers come in to buy it.

Jessica

And you have to have the staff, of course.

Chip

You have to have the staff and in all of that, but there’s still money to be made out there. And if you’re in the cannabis industry, and you’re like, oh, man, I can produce $170 $190 pounds in a greenhouse. And I can sell them for 350 or $500. But you’re making good money.

Jessica

Yeah, there’s still no doubt about that. It may not be the profit margin you think you should be getting? Or do you use to begin entitled to be or you feel entitled to be getting.

Chip

Right. But it is the sky is not falling? There? Will many people go out of business in Oklahoma?

Jessica

Well, of course. I mean, people have already gone out of business, and it’s just the nature of business, not 100% of all businesses don’t survive in any industry. So especially in a boom and bust scenario, especially in a boom and bust. Yep. Especially with the banking issues we have and the tax issues. You know, it’s not simple.

Chip

Well, you know, one interesting thing from my perspective is, you know, we operate hydroponic stores and, you know, potting soil manufacturing is, you know, how bad the manufacturers are and how much the prices have risen on our side. Inflation is truly shit. You know, in all of your cannabis, grow equipment, at Cultivate Colorado, Cultivate OKC you know, we operate an online shop there, cultivateokc.com cultivatecolorado.com. People from all over the country in the world buy products from us. And you know, we have seen, they’re still we still understand there’s the demand there. And even though we have a decrease in business in our retail shops in Colorado, and in Oklahoma, we’re still on an up three year average last year was a banner year for us. But we’ve been able to like still do pretty good and you know, we we made may operate a little bit differently than other people, but many of the stores that are you know, because we’ve been around for such a long time and many of the other stores including like, grow generation and you know, some of the other like smaller stores that either are just oversized or underdeveloped they’re they’re having a struggle hanging on to this industry. But you know, we have a really well established business Kobe, Colorado you know, we expect to weather this storm, you know, you know, well you know, we’re definitely talking to our customers you know, we’re offering the best prices we can we know everyone’s struggling you know, we see new products come out all the time. This past couple of years. We haven’t seen any new products come out

Jessica

There’s a couple new products that have come out.

Chip

I guess you’re right, I do have some products coming out. Yeah, growers our potting soil company if you’re not familiar with us, we make potting soil in and outside Denver, Colorado, some of the highest quality potting soil in the world made from cocoa fibre. We’re coming out with two new products right now that we’re actually using, you’ve been using you’ve been a prototyping our organic cocoa for a moment.

Jessica

Absolutely great cocoa

Chip

…so we’re coming out with a organic cocoa and a 7030. And we’ve actually put these off for a moment that are coming out with them right now at really great great prices because everybody’s having a hard time right now.

Jessica

Well it’s also you know, just thinking post COVID and everything going on with not only inflation, but it is a supply chain issues. So really noticing that there are things and all of our grocery stores and markets that we noticed just isn’t there anymore because of supply chain.

Chip

Oh yeah, it’s it has been hard we have we have bought more cocoa fibre than we thought we were going to use. We’ve really tried to get the biggest deals from our competitors coming from our suppliers, the best deals so we could, you know, be able to like me Eat this market because…

Jessica

Well I don’t even have it in stock when you need it struggling

Chip

to manufacture is you’re struggling to get materials. But yeah, so we got a 7030 Cocoa fibre coming out. We’ve got a organic cocoa fibre coming out right now. Call us at cultivate Colorado, look us up at growers grown on Instagram, cultivate Colorado on Instagram, and Facebook. And, you know, follow your progress there. If you’re in the Colorado area, we’re offering incredible prices to you right now on this product. So give us a call if you’re in Oklahoma or Michigan or anywhere in the country, if you’re a grower, or if you’re a grocery store, you know, drop us a line at growers cocoa or it goes big Colorado. We’d love to help it out. How do people getting get in touch with you and your organisation?

Jessica

In my organisation if you’re a commercial grower in Oklahoma, and you want clones, you know you can reach us at You can go to our website, which is clone dash city.com on Instagram, we’re at the clone city and also clone nursery. You know, because you gotta have more than one and then you can always just Google clone City, Oklahoma, and we come up oh my gosh, probably around 50 These days we really expanded our our mom rooms and got some great Oh, there are Yeah, we plant a bunch of seeds we select for specific finos and then we grow them at least two different ways in Oklahoma and then we put them out on the market so so we know they’re actually going to survive in greenhouses and outdoor yields

Chip

Great speaking to you today, Jessica. You know, I fortunately I get to get your wisdom on Cannabis industry all the time. Is there anything you’d like to say to fellow business?

Jessica

I always have things I want to say.

Chip

Women Business Owners or just cannabis business owners in general.

Jessica

I’m gonna say cannabis owners and business owners in general even if you’re not in the cannabis space yet and you’re just thinking of any business endeavour. It is a long game it there is no shortcuts. Like I said you may do well successfully at first and then that’s when your hurdles start. But don’t think this is an easy like I’m in and out and I’m gonna just it is a long game and enjoy it Have fun, please honour and respect the plants and your employees and your business contacts, the earth, all of it. But definitely it is not it is not a short game. It’s a long game. So be patient. Take deep breaths, connect with the other people in your industry community and don’t feel entitled to anything because we’re not

Chip

Hey, and I just want to say to you listeners. We love you all, keep the plant in your heart and just keep going you know times may be tough but just roll the biggest joint you can and fire it up.

Jessica

We’re about to!

Chip

This has been The Real Dirt!